top of page

Blog

This blog features content by student-members of Villanova Law’s Corporate Law Society.

Home: Welcome

Search

Big Oil and A Practical Playbook For Corporate Counsel

By: Nick Niemczyk, Class of 2028 Overview The Trump Administration’s 2025 climate agenda centers on one move at the Environmental Protection Agency: rescind the 2009 Endangerment Finding. That 2009 finding, EPA’s determination that greenhouse gases endanger public health and welfare, provides the legal basis for federal greenhouse-gas rules, including standards for new cars and trucks under the Clean Air Act. If the EPA rescinds the Endangerment Finding, vehicle standards and

Feb 124 min read

Monopolizing the Ticketing Industry: The DOJ’s Renewed Fight with Ticketmaster and Live Nation

By: Marissa Pereira, Class of 2028 Introduction Ticketmaster LLC (Ticketmaster) has a long-standing history of being the “largest live entertainment company in the world. [1] Selling tickets ranging from Sunday night football or large stadium concerts, Ticketmaster is the primary online source for obtaining tickets to events. [2] However, with this large hold over the ticket selling industry, Ticketmaster, and its subsidiary, Live Nation Entertainment Inc (Live Nation), hav

Feb 125 min read

From Quarterly to Semiannual: Assessing the Implications of the SEC’s Proposed Reporting Shift

By: Sam Lockwood, Class of 2028 Overview Quarterly earnings reports have long been the standard for U.S. corporate transparency. Since 1970, the Securities and Exchange Commission (SEC) has required publicly traded companies to release their financial statements quarterly on Form 10-Q. [1] However, the longstanding practice could soon change and have lasting impacts on investor sentiment and corporate governance. Chairman of the SEC Paul Atkins recently stated that the agenc

Nov 26, 20254 min read

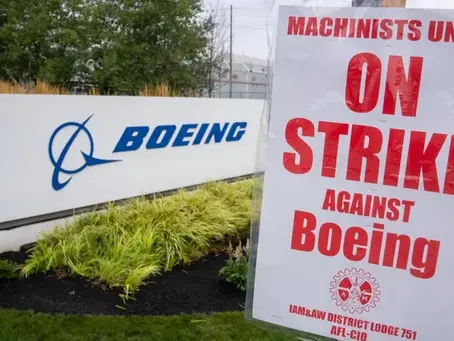

Picket Line Liability: Can Shareholders Sue Over a Strike?

By: Dominic McDermott, Class of 2028 Introduction: Boeing Strikes Out On November 6, 2024, 33,000 Boeing machinists came back to work. Their 53-day strike was over, and with lopsided results: while the machinists achieved salary increases of 38%, their employer lost $12 billion. [1] [2] Losses like Boeing’s are common with labor strikes and can have lasting impacts on shareholder value. A typical recourse for shareholders looking to recover lost company value is shareholder

Nov 26, 20254 min read

bottom of page