top of page

Blog

This blog features content by student-members of Villanova Law’s Corporate Law Society.

Home: Welcome

Search

From Quarterly to Semiannual: Assessing the Implications of the SEC’s Proposed Reporting Shift

By: Sam Lockwood, Class of 2028 Overview Quarterly earnings reports have long been the standard for U.S. corporate transparency. Since 1970, the Securities and Exchange Commission (SEC) has required publicly traded companies to release their financial statements quarterly on Form 10-Q. [1] However, the longstanding practice could soon change and have lasting impacts on investor sentiment and corporate governance. Chairman of the SEC Paul Atkins recently stated that the agenc

Nov 26, 20254 min read

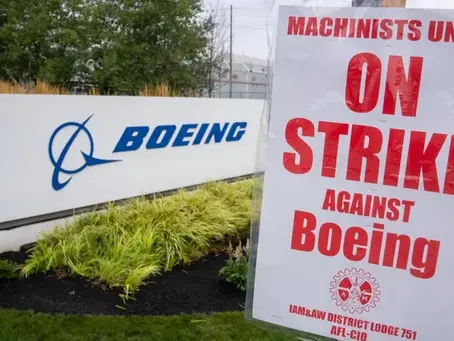

Picket Line Liability: Can Shareholders Sue Over a Strike?

By: Dominic McDermott, Class of 2028 Introduction: Boeing Strikes Out On November 6, 2024, 33,000 Boeing machinists came back to work. Their 53-day strike was over, and with lopsided results: while the machinists achieved salary increases of 38%, their employer lost $12 billion. [1] [2] Losses like Boeing’s are common with labor strikes and can have lasting impacts on shareholder value. A typical recourse for shareholders looking to recover lost company value is shareholder

Nov 26, 20254 min read

A Philadelphia Corporate Governance Success Story

By: Aryn Chartock, Class of 2028 What is Corporate Governance? Corporate governance is the system of “rules, practices and procedures that guide, control and govern a company.” [1] It often involves the dynamics between a company’s management, board of directors, shareholders, and other stakeholders, with the goal of ensuring accountability and fairness within a company’s operations. [2] Historically, corporate governance evolved from simple, often informal arrangements wher

Nov 14, 20257 min read

Artificial Intelligence and M&A: Efficiency Meets Ethics

By: Cole Hammel, Class of 2028 Overview Mergers and acquisitions (“ M&A ”) are evolving rapidly in response to technological change. As transaction complexity and deal sizes grow, corporate law firms are turning to artificial intelligence (“ AI ”) tools to help with M&A due diligence, contract review, risk screening, and post-closing monitoring. The impetus is efficiency: what once required days or weeks of manual review can now be compressed into hours. For dealmakers and co

Nov 14, 20258 min read

bottom of page